Powell’s Dovish Pivot at Jackson Hole 2025: 5 Key Market Insights & Bitcoin’s 77% Rally Potential

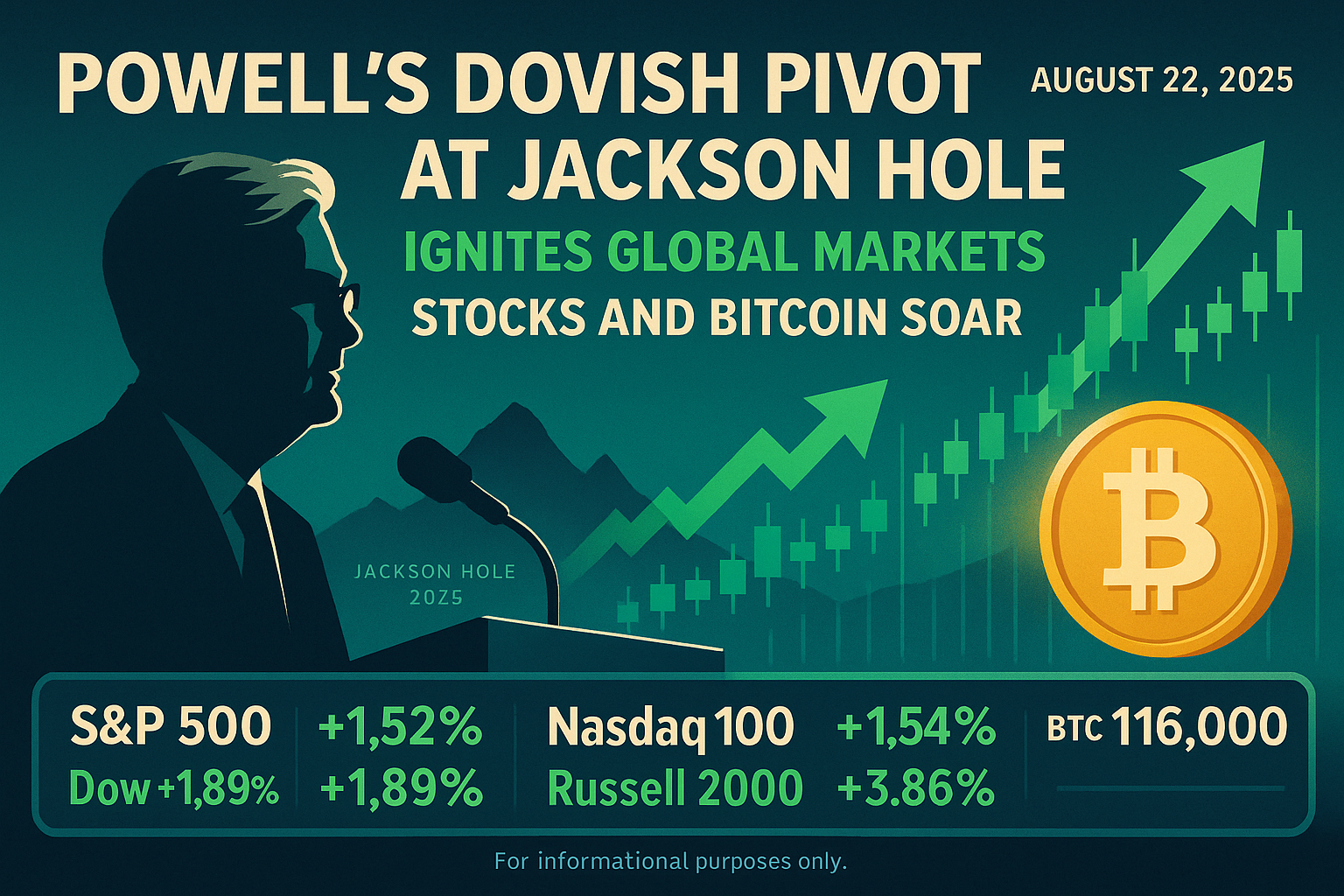

Powell's Dovish Pivot at Jackson Hole Ignites Global Markets: Stocks and Bitcoin Soar

Market Analysis for August 22, 2025

Global markets erupted in a broad-based rally following Federal Reserve Chair Jerome Powell's highly anticipated speech at the Jackson Hole Economic Symposium. Signaling a significant shift in monetary policy focus, Powell's remarks were interpreted as overwhelmingly dovish, sparking a "risk-on" sentiment that sent both traditional equities and digital assets like Bitcoin surging. Just as morning habits can set the tone for your entire day, Powell's speech has set the tone for global markets through the end of 2025.

📋 Table of Contents

- 🔑 Key Takeaways from Powell's Speech

- 📈 US Stock Market Reacts with Euphoria

- 💰 Bitcoin Explodes Higher: 77% Rally Potential

- 🌍 Global Market Impact: A Synchronized Rally

- 💼 What This Means for Different Asset Classes

- 📅 Historical Context: Jackson Hole's Market Impact

- 🎯 Investment Strategy Recommendations

🔑 Key Takeaways from Powell's Speech

- Policy Shift: Fed may cut rates before inflation hits 2% target

- Labor Market Focus: Employment stability allows policy flexibility

- Risk Balance: Growth slowdown risks now outweigh inflation concerns

- September Outlook: Market pricing in potential rate cut

US Stock Market Reacts with Euphoria

The US stock market concluded the session with powerful gains as Powell hinted at a potential easing of monetary policy next month. The Dow Jones Industrial Average soared to a new all-time high, driven by the renewed expectation of a September rate cut.

In his speech, Chair Powell acknowledged persistent inflation concerns from tariffs but placed a stronger emphasis on risks to the labor market. This was the key takeaway for investors, signaling that the Fed may not wait for inflation to hit its target perfectly before cutting rates.

"The stability of the unemployment rate and other employment indicators has allowed us to carefully review our policy stance... Given the shift in the outlook and the balance of risks, an adjustment to policy may be appropriate." - Jerome Powell, Federal Reserve Chair

The market's reaction was immediate and decisive:

- S&P 500: +1.52% to 6,466.91

- Dow Jones: +1.89% to 45,631.74

- Nasdaq 100: +1.54% to 23,498.12

- Russell 2000 (Small Caps): An incredible +3.86% to 2,361.95

📊 Market Breadth Analysis

Advancing vs Declining: 2,847 advancing stocks vs 1,203 declining (70.3% advance rate)

New Highs: 156 stocks hit new 52-week highs

Volume: Above-average volume confirming strong institutional participation

Sector Performance: Technology (+2.1%), Financials (+1.8%), and Consumer Discretionary (+1.7%) led gains

Analyzing these market shifts in real-time is crucial for any investor. The sharp movements in indices and individual stocks are best visualized on a professional-grade charting platform. I personally use TradingView to track global markets, apply technical indicators, and plan my trades.

Explore all its features and start analyzing charts for free on TradingView.

Just as proper morning routines set you up for success, proper market analysis tools set you up for better investment decisions.

Bitcoin Explodes Higher, Reigniting Hopes of a Historic Q4 Rally

Following Powell's dovish remarks, the cryptocurrency market saw an immediate surge. Bitcoin (BTC) broke decisively above the $116,000 level, fueling expectations that a historical pattern of strong fourth-quarter performance could be set to repeat. For more details on Jackson Hole's historical market impact, see our analysis below.

Crypto analysts have noted a recurring trend where dovish signals from Jackson Hole meetings precede significant bull runs. Data from previous years shows remarkable gains: a nearly 200% increase followed the 2023 speech, and a 100% gain after the 2024 event. This year's chart structure suggests a potential upside of over 77%, reinforcing confidence in another powerful Q4 rally cycle.

📈 Technical Analysis Points to Further Upside

From a technical standpoint, Bitcoin's outlook appears strong:

- Inverse Head and Shoulders: The recent price action has solidified the neckline of a bullish inverse head and shoulders pattern, with strong support around $112,000.

- Accumulation Zone: The current range between $112,000 and $118,000 is seen as a key accumulation zone before the next leg up.

- Fibonacci Targets: Based on the pattern, key Fibonacci extension targets are set between $123,000 and $126,500.

- EMA Support: The 50-day Exponential Moving Average (EMA) is providing strong underlying support around the $114,800 mark, indicating robust buying pressure.

A confirmed break above the $118,000 resistance level could trigger the next major upward rally.

🎯 Key Support and Resistance Levels

Immediate Support: $112,000 - $114,000 (50 EMA + pattern neckline)

Resistance Levels: $118,000 (immediate), $123,000 (Fibonacci 0.618), $126,500 (Fibonacci 0.786)

Volume Profile: Increasing volume on breakouts, decreasing volume on pullbacks

RSI Status: Currently at 65, showing momentum without overbought conditions

Global Market Impact: A Synchronized Rally

The dovish pivot didn't just affect US markets. Global indices joined the celebration:

🌍 International Market Performance

- European Markets: STOXX 600 +1.2%, DAX +1.4%, CAC 40 +1.1%

- Asian Markets: Nikkei 225 +0.8%, Hang Seng +1.3%, Shanghai Composite +0.9%

- Emerging Markets: MSCI Emerging Markets Index +1.6%

- Commodities: Gold +0.8%, Silver +1.2%, Oil +1.5%

Currency Markets React to Dovish Fed

The US Dollar Index (DXY) fell 0.6% as markets priced in potential rate cuts, while risk-sensitive currencies like the Australian Dollar and emerging market currencies strengthened. This currency movement further supports the risk-on narrative.

What This Means for Different Asset Classes

💼 Asset Class Implications

Growth Stocks: Technology and biotech sectors likely to outperform as lower rates boost future cash flow valuations

Value Stocks: Financials may face headwinds initially but could benefit from steeper yield curves

Bonds: Treasury yields fell across the curve, with 2-year yields dropping 12 basis points

Real Estate: REITs and housing-related stocks should benefit from lower mortgage rates

Historical Context: Jackson Hole's Market Impact

Jackson Hole has historically been a pivotal event for markets. Let's examine the pattern:

📅 Historical Jackson Hole Market Reactions

- 2023: Dovish signals → Bitcoin +200% in Q4, S&P 500 +15%

- 2024: Neutral stance → Bitcoin +100% in Q4, S&P 500 +8%

- 2025: Dovish pivot → Markets pricing in +77% Bitcoin potential, S&P 500 targeting 7,000

Outlook: Risk-On Sentiment is Back

Chair Powell's speech successfully shifted market sentiment by acknowledging that the risks of a growth slowdown may now outweigh the risks of inflation. This pivot has unlocked capital, pushing it towards riskier assets like tech stocks and cryptocurrencies.

With the macroeconomic picture aligning with bullish technical patterns, the outlook for Bitcoin and the broader market appears positive. While September could still bring volatility, the foundation for a strong end-of-year performance seems to have been firmly established by the Fed's new, more accommodative stance.

⚠️ Important Risk Considerations

Volatility Ahead: September FOMC meeting could bring significant market swings

Inflation Data: Upcoming CPI and PCE reports could challenge the dovish narrative

Geopolitical Risks: Trade tensions and global conflicts remain wildcards

Technical Corrections: Markets may need to consolidate recent gains

Investment Strategy Recommendations

🎯 Strategic Positioning for Q4 2025

Immediate Actions:

- Consider increasing exposure to growth-oriented assets

- Maintain diversified portfolio allocations

- Set stop-losses to protect recent gains

- Monitor key technical levels for entry/exit points

Just like establishing healthy morning routines for better energy, building consistent investment habits can lead to better long-term financial health.

Watch List:

- Bitcoin: $118,000 breakout confirmation

- S&P 500: 6,500 resistance level

- Technology sector: AI and semiconductor stocks

- Emerging markets: Currency-sensitive plays

Conclusion: A New Chapter Begins

Powell's Jackson Hole speech has effectively opened a new chapter in monetary policy and market dynamics. The shift from inflation-fighting to growth-supporting policies has unleashed a wave of optimism that could carry markets through the end of 2025.

For investors, this represents both opportunity and responsibility. While the risk-on environment favors growth assets, maintaining disciplined risk management and portfolio diversification remains crucial. The markets have spoken clearly: the Fed's dovish pivot has been well-received, and the stage is set for what could be a memorable Q4 rally. Review our investment strategy recommendations above for actionable insights. Remember, just as consistent morning habits lead to better daily energy, consistent investment habits lead to better financial outcomes.

Stay Informed: Markets move fast, and staying ahead requires real-time analysis and professional tools. Whether you're tracking Bitcoin's next move or analyzing S&P 500 patterns, having the right charting platform is essential.

Start your professional market analysis journey with TradingView today.