The 2025 U.S. Housing Market: The Buyer’s Moment Has Arrived

The 2025 U.S. Housing Market: The Buyer's Moment Has Arrived

For the past several years, the U.S. housing market has been defined by a single word: frenzy. Sky-high prices, non-existent inventory, and fierce bidding wars left countless prospective buyers feeling defeated. But as 2025 unfolds, the narrative is dramatically shifting. A window of opportunity is finally opening, allowing buyers to step out of the chaos and into a more rational, accessible market.

An analysis of market data and commentary from leading financial news sources like Yahoo Finance, Fortune, and Realtor.com reveals three seismic shifts that are fundamentally reshaping the real estate landscape. This shift, potentially influenced by broader discussions around economic support and financial well-being, promises a new era for homebuyers.

Three Seismic Shifts Creating New Opportunities

1. Mortgage Rates: A Wave of Dramatic Relief

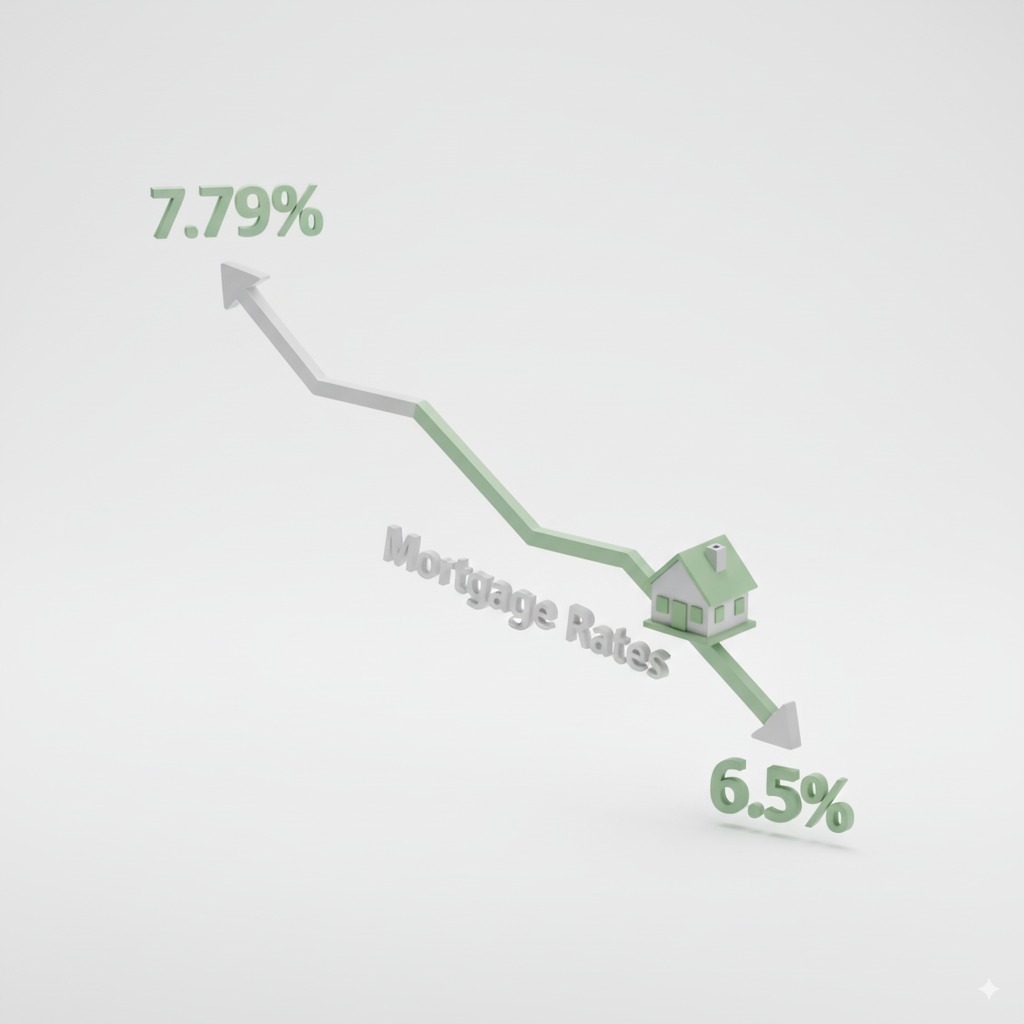

The single most impactful change is the cooldown in mortgage rates. After peaking at a staggering 7.79% in October 2023—a rate that crippled affordability—the market has seen a significant reversal. Fueled by expectations of Federal Reserve rate cuts and signs of a slowing labor market, rates have stabilized in the mid-6% range, with some lenders now quoting in the high-5% territory for well-qualified buyers.

- The Financial Impact is Massive: This is more than just a number on a screen. According to Realtor.com's calculations, on a median-priced home ($439,450) with a 20% down payment, the difference between a 7.79% rate and a 6.5% rate saves a buyer approximately $306 per month. Over the 30-year life of the loan, this amounts to over $114,480 in saved interest—enough to buy a luxury car or fund a college education.

2. Inventory Rebounds: The Return of Choice

The chronic shortage of homes for sale is finally beginning to ease, giving buyers something they haven't had in years: options.

- The "Rate Lock-In Effect" Thaws: The phenomenon where existing homeowners with ultra-low mortgage rates refused to sell is weakening. As life events necessitate moves, more existing homes are hitting the market. The National Association of Realtors (NAR) reports that inventory has climbed 15.7% from a year ago, reaching a more balanced 4.6-month supply.

- A Buyer's Playground in New Construction: The new-build market is brimming with inventory, holding roughly a 9.2-month supply. This surplus has forced builders to compete aggressively for buyers, offering significant incentives like closing cost credits, interest rate buydowns, and free design upgrades. The days of waiving inspections to win a bidding war are being replaced by thoughtful negotiations and builder-funded perks.

3. Price Growth Normalizes: The Fever Has Broken

While a nationwide price crash remains highly unlikely, the era of runaway price appreciation is officially over.

- From Double-Digits to Slow and Steady: Instead of the double-digit annual price hikes seen during the pandemic, growth has slowed to a much more sustainable 2-3%, according to the FHFA and Case-Shiller indices. This pace, barely keeping up with inflation, allows buyer incomes to catch up and removes the frantic pressure to "buy now before prices rise another 10%."

- Focus on Hyper-Local Data: National averages are less important now than ever. The key is to analyze trends in your specific target neighborhood. Data points like "days on market" and final sale prices versus list prices are your new best friends, providing powerful leverage in negotiations.

An Advanced Playbook for the Smart 2025 Homebuyer

In this transformed market, success belongs to the strategic and well-prepared buyer. Here is a guide to navigating your purchase.

- Look Beyond the Rate to the APR: Don't be swayed by a lender's advertised interest rate. Request quotes from multiple lenders on the same day and compare the Annual Percentage Rate (APR), which includes fees and provides a truer picture of the loan's cost.

- Ditch the 20% Down Payment Myth: Depleting your entire savings to reach a 20% down payment is a risky strategy. FHA, VA, and many conventional loans allow you to buy with less. Maintaining cash reserves is often more important.

- Use Rising Rents as Your Motivation: A fixed-rate mortgage locks in your largest monthly cost, acting as a powerful hedge against the inflation you see in rising rents.

- Remember 'PITI': Calculate Your True Monthly Cost: Your payment isn't just Principal and Interest. It's also property Taxes and homeowners Insurance. Calculate this full amount.

- Don't Time the Market; Time Your Life: The right time to buy is when your personal finances are stable and you're ready to settle down, not when a headline tells you to.

Frequently Asked Questions

What is the biggest change in the U.S. housing market for 2025?

The most significant change is the dramatic relief in mortgage rates. After peaking near 7.79% in 2023, rates have stabilized in the mid-6% range, with some lenders even offering rates in the high-5% territory. This cooldown in borrowing costs makes homeownership significantly more affordable than in previous years.

Is 2025 a good year to buy a house?

Yes, 2025 is shaping up to be a much better year for buyers. Key factors include lower mortgage rates, a significant increase in housing inventory (both new and existing), and cooled-down price growth. This gives buyers more choices, greater negotiating power, and improved affordability compared to the frenzied market of recent years.

Are house prices expected to drop in 2025?

A nationwide price drop is not expected. However, the extreme price growth has ended. The annual rate of appreciation has slowed to a much more sustainable 2-3%. This means the market has stabilized, and in some local areas, prices may be flat or see slight dips, giving buyers more leverage.

Should I wait until I have a 20% down payment to buy a home?

Not necessarily. While a 20% down payment helps avoid Private Mortgage Insurance (PMI), many loan programs like FHA (3.5% down) and conventional loans (3-5% down) allow you to buy with less. It's often more important to maintain cash reserves for emergencies and other costs than to deplete all your savings for a large down payment.

In conclusion, the frenzied, seller-dominated market of the early 2020s has given way to a more balanced, rational landscape. The time for emotional, rushed decisions is over. The era of the informed, strategic, and empowered homebuyer has begun.